Silver is among the most widely utilized and essential precious metals in modern society, according to The Silver Institute, which has dubbed the metal as “The Element of Change.”1 It was most likely mined in Turkey around 5,000 years ago. During the discovery of America, large deposits of silver were found are in North and South America.2

Silver has been described as beautiful, valuable, malleable, and durable. It is considered the best conductor of electricity, withstands high temperatures, and is a great conductor of heat.1

Silver was used in the Greek and Roman empires to prevent infections,1 and as a disinfectant for water and food.3 Because of its antibacterial properties, it is used for cutlery, bandages, and medical devices.2

Less than 30 percent of the silver produced comes from silver mines. Most of the silver produced is actually by-product of mining for gold, copper, lead, and zinc.1

For most of human history, silver has been used for coins and jewelry. Other uses include medicine, electronics, and photography.2

Silver Pricing: Understanding the Basics

Silver, like gold, is considered a commodity. As such, the price of silver is driven by supply and demand, as well as speculation and market influences.

Here are some factors that affect the price of silver:

- The value of the dollar: When looking at the relationship of silver price to the dollar’s value, when the dollar of the value drops, the price of silver generally rises. Silver is viewed as a hedge against inflation.6

- Supply and demand: Generally, silver prices rise with increased demand or reduced supply.4

- Inflation: High inflation leads to higher silver prices as the dollar’s purchasing power weakens. Low inflation strengthens the dollar and lowers silver prices.4

- Mining productivity: While silver is relatively rare, silver mining is not the only source of silver. It is also the by-product of refining other ores like gold, copper, lead, and zinc, which adds to the silver supply when silver mining is down.

Current Market Snapshot: Today’s Silver Price vs. Today’s Gold Price

The price of silver has demonstrated substantial fluctuations over the past 50 years, but it has experienced a bit of stability since 2020 with prices in the low- to mid-$20s.

The trajectory of the price of silver often tracks that of the price of gold, however, at a much lower rate.4

As of April 25, 2024, the price of silver is $27.18 per ounce whereas the price of gold per ounce $2,318.95 (per Kitco).

What is the silver spot price?

The spot price of silver is what an investor will pay to buy one troy ounce of silver at that moment.

Per Kitco, the price of silver is $27.18 per ounce as of April 25, 2024.

How the Silver Spot Price is Calculated

While the spot price is influenced by various factors like economic indicators, geopolitical events, industrial demand, investor sentiment, and currency movements, it is primarily set by trading on global commodities exchanges, with the most significant being the London Bullion Market Association (LBMA) and the Chicago Mercantile Exchange (CME). Silver futures and derivatives also play a role. The spot price is updated continuously throughout the trading day as trades occur, reflecting the real-time market conditions.8

Silver Price History

Silver prices have exhibited a long-term upward trend, rising from $1.80 in 1969 to $23.39 in 2023. The highest average annual closing price was recorded in 2011 at $35.12 during a period of global financial instability. A notable peak in the market occurred in 1980 with a record high of $49.45, influenced by the Silver Thursday crash. However, this period also saw significant volatility, with a drastic 51.86% drop in 1980 following a 434.88% rise in 1979, based on an analysis of historical silver prices.9

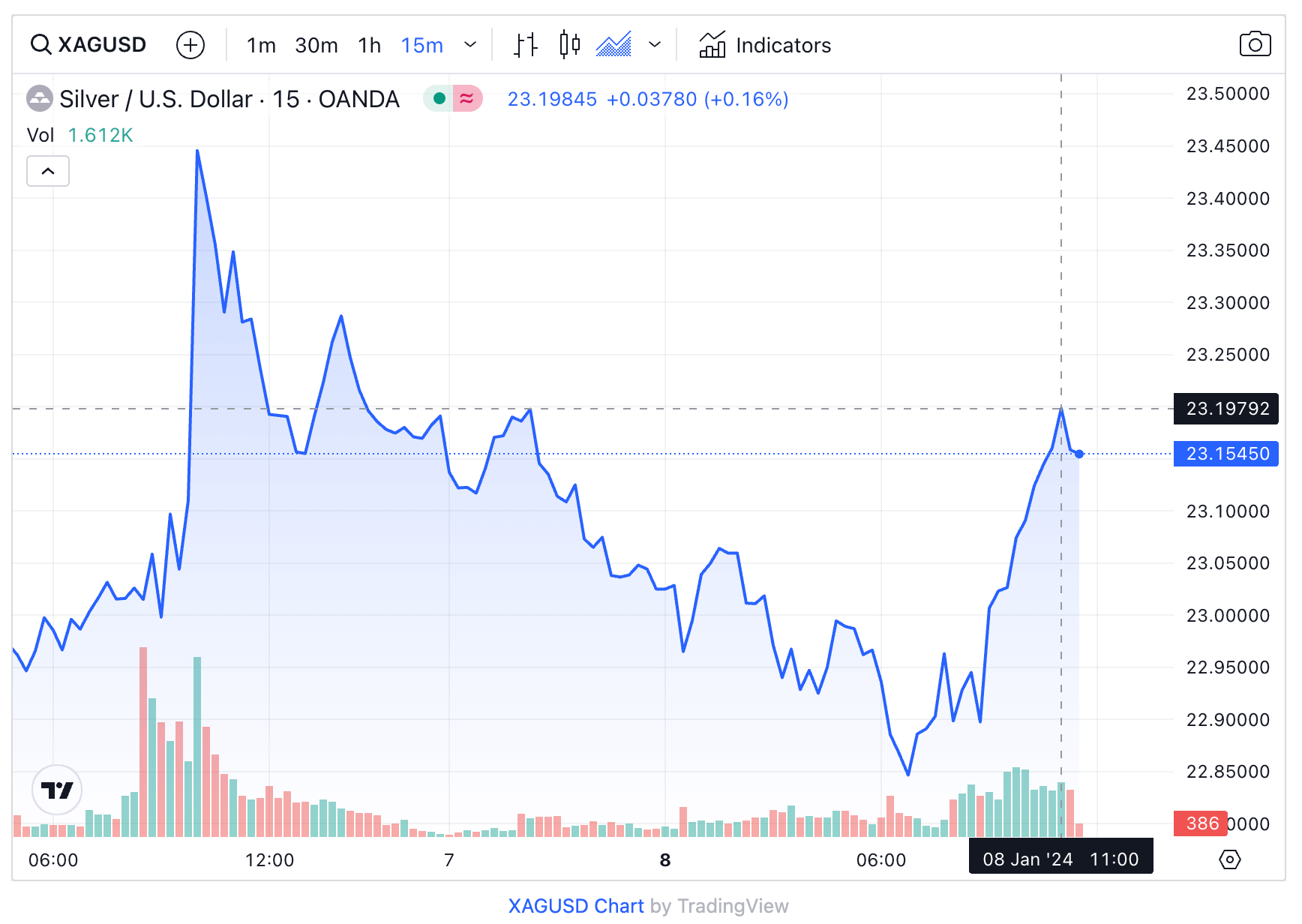

Silver Price Chart

In recent years, silver prices have shown more stability, with less dramatic annual fluctuations. For example, 2023 witnessed a modest increase of 1.03%. The market’s behavior has varied by decade; the 1970s and early 1980s experienced high volatility, while the 2000s onwards saw a trend of steady growth. Economic events like the 2008 financial crisis and the 2020 COVID-19 pandemic have influenced spikes in silver prices, highlighting its status as a safe-haven asset.

Overall, silver prices have followed an upward trajectory since 2019, moving from $17.90 to $24.21 by 2023. This data underscores silver’s dynamic nature in the commodities market, influenced by a blend of economic factors and market sentiments.

Silver Price FAQs

How much is 1oz silver worth today?

In recent months, silver has been fluctuating in the low- to mid-$20 range. The price of silver is determined by various factors such as supply and demand, economic indicators, geopolitical events, and market speculation. This causes the silver price to change every day. As of April 25, 2024, the price of silver is $27.18 per ounce.

Can silver reach $100?

There is speculation the price of silver can reach $100. With the transition to green energy and the rise of artificial intelligence technologies, the demand for silver is expected to rise.10 However, for silver to reach $100, it would have to increase by about 400%.

What has the price of silver been doing?

Over the past three years, the price of silver has been stable. Despite its price fluctuations, the price of silver has been generally rising since the 1970s.9

Will silver hit $30 an ounce?

Silver hit the $30 threshold in 2010, 2011, 2012, and 2013. The silver price came close in 2020 and 2021, when it hit highs of $29.26 and $29.42, respectively.9

What is a troy ounce of silver?

The spot price of silver is based on a troy ounce, which is roughly 31.1 grams. By comparison, a regular ounce is 28.35 grams. Per Kitco, the price of silver is $0.88 per gram as of April 25, 2024.

Is silver worth selling right now?

If you have unwanted items you want to sell, then it may be worth it to you to sell now. Cash for Silver USA buys nearly all items that are gold, silver, platinum, or contains diamonds. In addition to free, insured shipping and fast payments, we also offer a Price “Beat” Guarantee — we will beat any competitor’s written offer or return your items to you free of charge. Request your free Appraisal Kit now.

Sources:

1. The Silver Institute – Silver: The Element of Change, https://www.youtube.com/watch?v=jRwUmGpmF38. Retrieved Dec. 26, 2023.

2. Wikipedia – Silver, https://en.wikipedia.org/wiki/Silver. Retrieved Dec. 26, 2023.

3. National Center for Biotechnology Information – Silver: an age-old treatment modality in modern times, https://pubmed.ncbi.nlm.nih.gov/20543642. Retrieved Dec. 26, 2023.

4. Wikipedia – Silver as an investment, https://en.wikipedia.org/wiki/Silver_as_an_investment. Retrieved Dec. 27, 2023.

5. The Silver Institute – Silver Price, https://www.silverinstitute.org/silver-price. Retrieved Dec. 27, 2023.

6. MacroMicro – US: Dollar Index vs. Silver Price, https://en.macromicro.me/collections/3351/commodity-silver/26720/us-dollar-index-vs-price. Retrieved Dec. 27, 2023.

7. The Silver Institute – Silver Supply & Demand, https://www.silverinstitute.org/silver-supply-demand. Retrieved Dec. 27, 2023.

8. Bullion By Post – How is the price of silver set?, https://www.bullionbypost.co.uk/index/silver/how-is-the-price-of-silver-set. Retrieved Dec. 27, 2023.

9. Macrotrends – Silver Prices – 100 Year Historical Chart, https://www.macrotrends.net/1470/historical-silver-prices-100-year-chart. Retrieved Dec. 27, 2023.

10. Seeking Alpha – Silver May Surge To $100 Thanks to AI, https://seekingalpha.com/article/4654303-silver-may-surge-to-100-thanks-to-ai. Retrieved Dec. 27, 2023.

ABOUT CASH FOR SILVER USA

Cash for Silver USA is a prominent online buyer of silver, gold, platinum, and palladium in the United States. Since 2005, we have paid tens of millions to tens thousands of customers for their unwanted or broken precious metal jewelry. We offer a quick and straightforward selling process, ensuring customers receive prompt and competitive offers for their items. Learn more about us or request your free Appraisal Kit now: